After a horrible end to 2018 for Netflix, the company is looking to bolster its valuation with their largest price increase since the company launched 12 years ago.

The new pricing increase will be between anywhere from 13-18 percent depending on the plan:

- Basic will change from $7.99 to $8.99 per month.

- Standard will change from $10.99 to $12.99 per month.

- Premium will change from $13.99 to $15.99 per month.

The increases will take effect immediately for new customers. Existing subscribers will see the price increase on their bills over the next three months. Customers in Latin American, the Caribbean, and some other countries will also see the higher rates. Major international markets won’t be affected.

David Trainer, of New Constructs, said during an CNBC interview that, “I think this price hike represents the key delima for Netflix. They’ve got to raise the price in order to keep from running out of money. And every time they raise their prices it makes their competitors more viable.”

Trainer went onto say that, “Netflix now has 139 million paying members. Their current share valuation implies they need to have over 500 million paying subscribers at $20/month.”

Even at subscriber base of 250 million, Netflix would have to charge of $40 per month to justify the current stock value, according to the numbers done by New Constructs.

Trainer makes the point that if Netflix continues to raise prices, it paints a very different picture in being able to compete with newcomers like Disney, Hulu, ect. Price increases will get more people to consider the alternatives out there, impacting Netflix’s ability to bring on more subscribers.

Subscribers has been a big selling point for Netflix valuation. The company has lost over 10 billion in cash flow over the last 5 years by adding their own Netflix original content. So now they’ve found themselves in a sort of catch-22 scenario where they can raise prices and lose subscribers, or they keep prices lower and not bring in enough revenue to justify the cash flow spending on unique content.

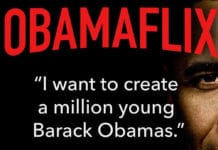

Another part of this story has been Netflix’s inability to grow subscribers in the USA. We reported that Netflix decided to alienate their conservative subscribers by partnering with far-left politicians like Barack Obama with a deal rumored to be up in the 8 figures. No doubt this relationship has had an effect, and continues to effect their ability to capture the US market.